Affordable Term Life

Affordable Term Life:

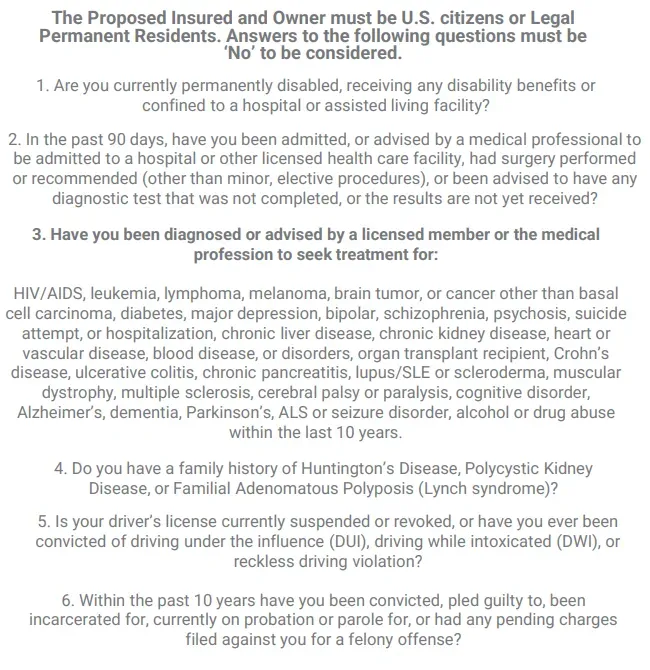

Affordable term life is easier than ever. If you can answer no to the following questions, you can get an instant approval at a great rate.

Affordable Term Life: Qualifying questions, example

Affordable Term Life: Fully underwritten/No underwriting

Partial or simplified underwriting:

When it comes to Affordable Term Life many get confused about the process of underwriting. Simply put, answering the questions above is a form of underwriting (field underwriting). A licensed agent/broker would facilitate this by asking those questions and submitting to the proposed insurance carrier. This is simplified issue and generally requires nothing more for those who qualify. This type of policy has a good balance of ease of approval and coverage amount. Working with a broker will get you the best product and price to fit you and your family's needs. 89% of Americans researching or shopping for life insurance online indicated that their preferred method for purchasing coverage is to work with an independent agent or other financial advisor.

Fully underwritten:

In general, fully underwritten affordable term life would be of a specified term for a higher amount of coverage in which, you must pass a medical exam. This option is a good choice for new homeowners that are starting a family. By going through this underwriting process and proving insurability to this extent typically qualifies healthy individuals with a better rate.

No underwriting:

Guaranteed acceptance or guaranteed issue is the type of policy that requires no underwriting. GIWL this is an acronym that may be familiar. Guaranteed issue whole life for example. Many people who look to this type of product are between the ages of 50-85 and are getting policies of a much smaller amount. The typical use would be for burial or cremation known as Final Expense insurance. Some people may find the underwriting process intimidating or have health concerns that may disqualify them from an underwritten product. GI, guaranteed issue is for those individuals who simply want to get covered and make a premium payment and be done with it. While this is a good option for someone who otherwise won't get coverage, this type of policy will come with a waiting period and usually graded benefits. This means if you die before this waiting period has lapsed your beneficiary will not get the full-face value.

Get a Quote:

Now that you understand some of the basics, you can generate a Quote on your own for a simplified issue policy. For more options and to speak with an independent broker for the best available product and pricing simply submit the request on Calendar for life.